The Foreign Investment in Real Property Tax Act (FIRPTA) is a federal U.S. tax law that imposes income tax on foreign persons selling U.S. real estate interests. Passed in 1980, FIRPTA is a critical piece of legislation that affects both foreign sellers and U.S. buyers in real property transactions.

It is relatively simple for foreign nationals to buy and sell real estate within the United States. However, these transaction are generally subject to a 15% tax withholding rate (as of 2023). This tax withholding is triggered by FIRPTA, which under most circumstances requires the buyer to withhold the taxable amount from the foreign seller and remit it to the Internal Revenue Service (IRS). The foreign seller can then claim a refund of the withholding tax if they file a U.S. tax return and pay the appropriate amount.

FIRPTA is designed to ensure that foreign persons who sell U.S. real estate pay their fair share of U.S. taxes. The law also helps to protect U.S. taxpayers from foreign investors who may try to avoid paying taxes on their U.S. real estate gains.

Implications of FIRPTA for Foreign Sellers and U.S. Buyers:

- Foreign Sellers

From the perspective of a foreign seller, FIRPTA can have significant tax implications. When a foreign person sells a U.S. real property interest, the IRS treats the gain or loss as effectively connected with a U.S. trade or business. Consequently, the foreign seller is subject to U.S. income tax on the gain at regular rates.

Under FIRPTA, the buyer is generally required to withhold 15% of the amount realized on the disposition, which generally includes the sales price. This withholding serves as a prepayment of the foreign seller's anticipated tax liability. However, the actual tax liability may be more or less than the withheld amount, depending on the seller's income, deductions, and credits. If the withheld amount exceeds the seller's ultimate tax liability, the seller can file a U.S. income tax return to claim a refund for the excess. Conversely, if the withheld amount is less than the tax liability, the seller must pay the difference when filing the tax return.

- U.S. Buyers

From the perspective of a U.S. buyer, FIRPTA imposes a significant responsibility. The buyer is considered the withholding agent and is responsible for determining whether the seller is a foreign person. If the seller is indeed a foreign person, the buyer must generally withhold 15% of the amount realized and remit it to the IRS. Failure to do so can result in the buyer being held liable for the tax that should have been withheld, along with interest and penalties.

However, there are exceptions to the FIRPTA withholding requirement. For instance, if the property is purchased for use as a residence and the sales price does not exceed $300,000, the buyer is not required to withhold tax under FIRPTA. Nevertheless, the foreign seller is still liable for U.S. tax on the gain from the sale.

The Role of the Title / Closing Company as Withholding Agent

In a real estate transaction subject to FIRPTA, the title agent oftentimes assumes the role of the withholding agent. As the withholding agent, the title agent is responsible for ensuring that the correct amount of tax is withheld from the foreign seller's proceeds and remitted to the IRS.

Here are the key responsibilities of the title agent in this role:

-

Determining FIRPTA Applicability: The title agent must first determine whether FIRPTA applies to the transaction. This involves confirming whether the seller is a foreign person (or foreign entity if a trust, estate, corporation or REIT) and whether the property being sold is a U.S. real property interest.

-

Withholding the Correct Amount: If FIRPTA applies, the title agent is responsible for withholding the appropriate tax amount due on the sale (generally the total sales price). This amount must be withheld from the foreign seller's proceeds at closing.

-

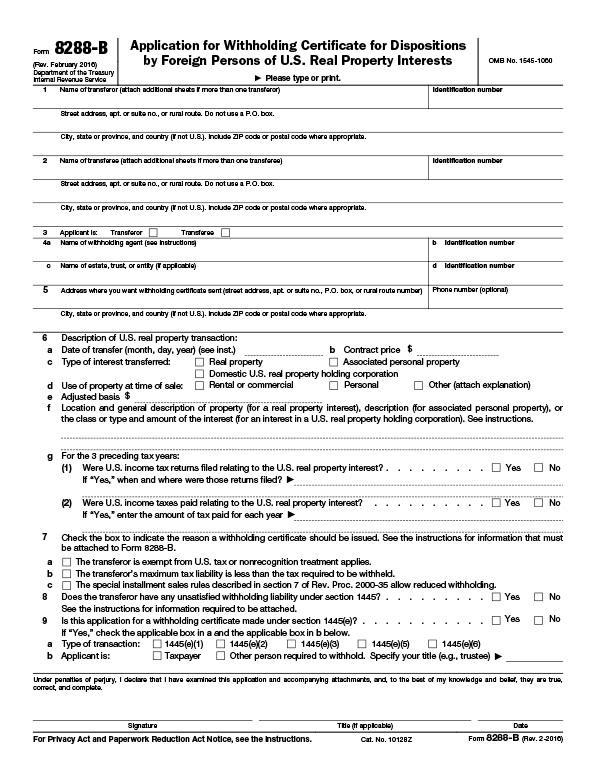

Reporting the Transaction: The title agent must report the transaction to the IRS. This is done by filing IRS Form 8288, "U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests" and Form 8288-A, "Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests". The title agent must attach a copy of the withholding certificate, if one was issued, to the forms.

-

Remitting the Withheld Tax: The title agent must remit the withheld tax to the IRS by the 20th day after the closing date. If a withholding certificate application is submitted to the IRS before the date of transfer, the withholding tax must be remitted within 20 days after the IRS mails the withholding certificate or notice of denial.

-

Record Keeping: The title agent must keep a record of the transaction, including copies of the forms filed and the amount of tax withheld and remitted.

Obtaining a FIRPTA Withholding Certificate

A FIRPTA Withholding Certificate is a document issued by the Internal Revenue Service (IRS) that can reduce or eliminate the amount of tax that must be withheld from the sale of U.S. real property by a foreign person or entity.

There are several advantages to obtaining a Withholding Certificate:

-

Reduced Withholding: The primary advantage is that it can significantly reduce the amount of tax withheld from the sale. This can be particularly beneficial if the seller's actual tax liability is less than the standard withholding.

-

Faster Refunds: If the withheld amount exceeds the seller's actual tax liability, the seller can claim a refund when filing a U.S. income tax return. However, this process can take a long time. If a Withholding Certificate is obtained that reduces the withholding to the amount of the seller's actual tax liability, the seller can receive the correct amount of sale proceeds faster.

-

Increased Certainty: A Withholding Certificate provides certainty about the amount of tax that will be withheld. This can make the transaction smoother and more predictable for both the buyer and the seller.

The following are the steps needed to obtain a Withholding Certificate:

-

Application: Either the buyer or the foreign seller can apply for a Withholding Certificate. The application must be submitted to the IRS on Form 8288-B, "Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests".

-

Review: The IRS reviews the application and determines whether to issue a Withholding Certificate. This decision is based on various factors, including the seller's maximum tax liability and whether the buyer or seller has agreed to notify the IRS of any non-compliance.

-

Issuance: If the IRS approves the application, it issues a Withholding Certificate that specifies the amount of tax that must be withheld from the sale proceeds. This amount may be less than the standard tax rate required under FIRPTA, or even zero, depending on the circumstances.

-

Withholding: If a Withholding Certificate is issued, the buyer must withhold the amount specified in the certificate. If the certificate is denied, the buyer must withhold the required tax amount stipulated by FIRPTA rules.

While, a Withholding Certificate can be a very valuable tool in a FIRPTA transaction, the process of obtaining one can be complex and may require the assistance of either a tax professional or a tax attorney experienced in matters of international taxation.

Obtaining a Tax ID Number

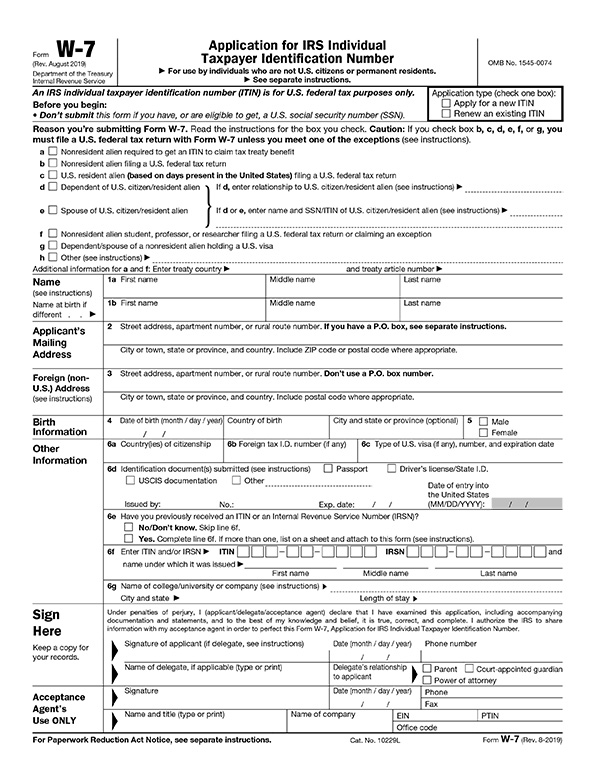

Applying for a Withholding Certificate will require the foreign seller to obtain a tax ID number from the IRS if they do not already have one. For a foreign individual, the Tax ID number is usually an Individual Taxpayer Identification Number (ITIN).

The following are the steps needed to obtain a tax ID number:

-

Form: The first step is to complete IRS Form W-7, "Application for IRS Individual Taxpayer Identification Number".

-

Documentation: You must also provide proof of identity and foreign status. This typically includes a passport or national identification card.

-

Submission: Submit Form W-7, along with the supporting documentation, to the IRS. This can be done by mail, at an IRS office, or through an Acceptance Agent authorized by the IRS.

-

Processing: The IRS will review the application and, if approved, issue an ITIN through the mail.

The information provided on this page is intended to serve solely as a general overview of the Foreign Investment Real Property Tax Act and is not to be relied upon as professional tax or legal advice. Buyers or sellers potentially subject to FIRPTA withholding should consult with a tax / legal professional before entering into a contract for sale or purchase of real property within the United States.